Starting a crypto exchange business in South Korea, or anywhere else, can be a great opportunity given the growing interest in digital currencies. Nexcenz goal is to make the process as smooth as possible while adhering to the rules and offering a secure, user-friendly platform. Here's a simplified guide to help you understand how to get started.

Understand the South Korean Crypto Market

South Korea is one of the biggest markets of cryptocurrencies. The country sits above with a regulated approach to all crypto activities to enhance innovation with security to consumers and even their protection. This translates into the necessity of making the market acquainted with its trends, demands, and existing competition before setting up a crypto exchange within South Korea.

Demand for Cryptocurrencies

South Koreans are very active in trading digital money assets like Bitcoin, Ethereum, and new tokens.

Regulatory Interventions

Such regulations carve a niche for the government in subjecting businesses to legal operations while guaranteeing compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

Draw a Business Plan

The first step is that a business is devised with an ironclad plan, and so is a crypto exchange. An effective plan would guide the business, probably with goals, and may entice investors if necessary.

Legal Permissions and Licenses

Tight local laws are in place for operating a crypto exchange in South Korea. Before you can launch your platform legally, you need to comply with a bunch of regulations:

1. Virtual Asset Service Provider (VASP) License

The government requires licenses to be received by the exchanges from the Financial Services Commission (FSC). This license is to make sure that your platform observes the rules of KYC and AML making it fraud and money laundering proof for users.

2. FIU Registration

All crypto exchanges must register before the FIU for suspected activity reporting and anti-money laundering legislation compliance.

3. Identification and Compliance with Local Taxation Rules

As the Government of South Korea taxes all transactions entered into with crypto, your business needs to get advice on tax liabilities. Full compliance to avoid penalties.

4. Building the Platform

It's now time to build the actual exchange. Whether in-house developed or through a tech partner, this is the important step in guaranteeing the secure and smooth experience.

Here's everything you need:

Security Features

Security will always be your priority in the crypto industry. You will invest in strong encryption, two-factor authentication or 2FA, cold storage for digital assets, and regular security audits.

User-Friendly Interface

The design of your exchange should be easy to navigate. Guarantee even beginners understand how to use your platform.

Liquidity

Another key way to run a successful exchange is liquidity, which is simply how easy it is to buy and sell assets. You'll need to make sure that there's enough liquidity at your platform to make transactions happen without delay or price slippage.

Get Banks as Partners for Fiat Integration

Depositing and withdrawing traditional currencies (fiat) is one big challenge that cryptocurrency exchanges have to work around. Much of the South Korean banks are becoming increasingly familiar with processes in regard to cryptocurrency exchanges, but not without the strict and thorough way of complying. You will have to:

Develop KYC and AML Procedures

These are KYC and AML procedures into which all crypto exchanges in South Korea should put up as part of its legal requirements. These procedures will not only help one avoid tarnishing the name of an organization but also help one reduce fraudulent activities as well as money laundering.

KYC Procedure

To trade on your platform, users shall be required to submit identification documents such as a passport or government-issued ID, as well as verify their personal details.

AML Approach

All your transactions must be monitored for suspicious activity, and any such activity reported to the appropriate authorities. Such activities include but are not limited to large withdrawals, unusual trading behavior, or involving transacting to or from high-risk countries.

Scale and Stay Updated

Once your platform is up and running, focus on growth and keep track of market trends, new regulations and emerging technologies. This will help you stay competitive and guarantee you are offering the best experience for your users.

Scalability

As the traffic and trading volume on your exchange increase, make sure that your platform can withstand the stress.

Stay Compliant

Follow the South Korean crypto regulations. Non-compliance may cause fines or even shutting down your exchange.

Cryptocurrency Usage in South Korea

Consider Top Cryptocurrency Exchange Clone Scripts for Korean Market

If you want an efficient and cost-effective way to launch your exchange, utilizing Top Cryptocurrency Exchange Clone Scripts Korean Market is the best option. These pre-constructed solutions can cater to the unique specifications for the South Korean market and come with the required features as KYC/AML compliance, liquidity, and robust security. These scripts can also be tailored according to your business objectives and get your platform up in no time.

By using these clone scripts, you can save on development time and put more emphasis on other critical issues like customer care, and compliance.

Conclusion

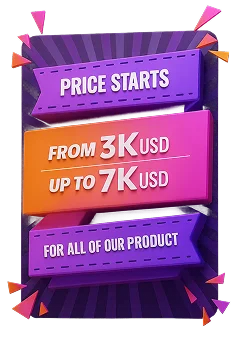

Nexcenz offers every type of crypto-related projects from small to large-scale enterprises. The part where we shine is the rendering of all kinds of crypto services such as centralized exchange, decentralized exchanges, white-label crypto exchanges, and many more.

We will provide you with the best-of-class Crypto Exchange Development Services in the way of creating your crypto exchange platform that has market-pulling features and advanced security measures.

Customer feedback and reviews are our major concerns! Here we have shared a Ratings of our reputed clients

You let us know what you need, Technical experts will call to review your needs in detail.We promise to keep all information private.