A DeFi DEX Aggregator goes a step further, being a platform for finding the best rate to trade cryptocurrencies. It aggregates data from various Decentralized Exchanges (DEXs) and puts all the information in one place for users to trade conveniently, quickly, and less cost-effectively.

Your platform will bring together traders on various exchanges to enhance liquidity (the ability to buy and sell readily).

More traders who engage your business in their best rates enhance transaction fee income and other income streams.

It can incorporate different tokens and assets to make swapping those assets easy for users.

Users can be guaranteed the best possible price at any second since they're provided with comparative pricing across all platforms.

This will directly work on the blockchain to obtain the data and execute trades. Everything happens on-chain that is public and secured.

This will obtain the data off the chain and hence sometimes perform faster.. This is a less transparent setup altogether.

Basically, it allows the user to trade an asset from one blockchain to be swapped to Binance Smart Chain.

This one aggregates data for non-fungible tokens (NFTs) alone, with users trading for different NFTs among different platforms.

A hybrid model that combines features of centralized exchanges along decentralized exchanges. Centralized DExes offer fast transactions but not as much security as decentralized ones.

An entirely decentralized one, where no central authority governs trades. Users have full control over their assets, guaranteeing increased privacy and security.

Automated Market Maker (AMM)-kind of platforms have smart contracts in place to allow trading without an order book. These aggregators will collect data from AMMs and give users the best rates.

A blend of centralized and decentralized characteristics. It gives users freedom to trade in different ways based on their needs.

Building a custom platform that finds the best prices across different crypto exchanges.

Connecting to pools of tokens where users trade or earn rewards.

Creating the code that automatically handles trades and transactions on the blockchain.

Checking the system for bugs and improving speed and safety.

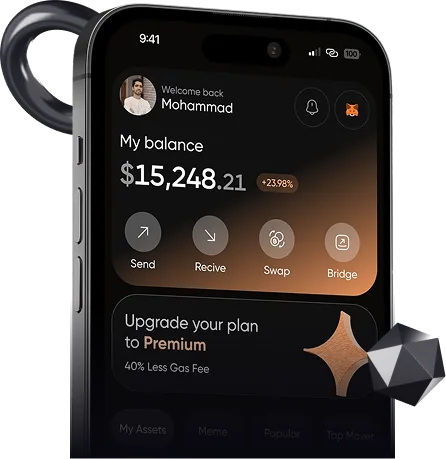

Offer users a simple and straightforward dashboard where users can see all their trading options in one place.

Grant instant access to decentralized finance (DeFi) applications from the aggregator platform.

Let users instantly compare real-time prices from several DEXs to get the best bargain.

Offer automated trade strategies to assist users in making informed decisions.

The facility for token swapping in minimal time (say, swapping Bitcoin to Ethereum) without leaving the platform.

Allow the users to perform token swaps across all blockchain networks.

Allow the users to stake their cryptocurrency assets to earn rewards and utilize their holdings optimally.

Provides the users analytics and insights to monitor trades and take informed decisions.

We designed a simple and smooth process users will experience when using our DeFi DEX aggregator development Services. A step-mapped explanation of the usage flow from the users' perspective is as follows

The user should create an account. The second part is that users provide basic details during registration or by simply connecting the wallet. This is how they get started using the platform, of course saving preferences and transaction history in a secure way.

Once the account is set up, users connect their cryptocurrency wallet (such as MetaMask, Trust Wallet, etc.). Now they will be able to manage their assets and trade directly using the wallet.

Users can browse different cryptos or tokens. From this point on, the aggregator will use information sources from all DEXs to show its users the best prices and liquidity for a vast array of assets.

It will automatically compare the price across various DEXs. Users will see the best prices and make informed decisions with time and money saved in avoiding viewing each DEX separately.

After finding a good price, users can swap tokens (like trading Bitcoin for Ethereum) in no time. The easy process and transparent transaction fees keep you from leaving the platform.

The DeFI Aggregator Development Solutions offers cross-chain swaps for users who want to switch assets across blockchains. It is just a couple of clicks for them to move their assets across different networks.

Staked tokens can be earned directly within the platform for rewards or interest for the user, thus maximizing appreciating assets while awaiting the next trade.

Users can retrieve a detailed history of all their transactions and track their performance. The analytics tools help users understand their trading patterns, hence making better future decisions.

After the whole trading process is done, the user can withdraw or transfer their assets back to their wallet anytime. The process is secure and fast.

Building an efficient DEX aggregator involves a number of steps to provide an uninterrupted, secure, and efficient experience for users. Below is a step-by-step breakdown of building the DEX aggregator platform

We start from the requirements and aim to achieve the goals set forth by your enterprise. This basically includes determining what type of aggregator you would want: on-chain, off-chain, cross-chain, etc., and other features you would like to have, such as real-time price comparison, token swaps, etc.

An easy answer once the customer requirements are well defined; our design team will design a user-centric interface. The interface will be intuitive enough for even the layman to operate on. The UI should be clean enough to give useful information but not too irritating or full of ads to dissuade the user.

With the specified virtual tools in mind, we build in all the kernel functions needed. We also make sure the user gets wallet integrations that are secure and able to connect easily with his/her wallet.

We are rigorously tested to work before being put live. This involves functional tests, security audits, and user experience testing. We check for bugs and fix them, so that the platform is stable enough and secure.

After the tests, the platform is deployed and is made visible to the users. The launch is monitored closely to catch any bugs early on and guarantee seamless experiences.

Continuous support is given once the platform is live. We fix bugs, issue updates, and improve based on user feedback. We also track upcoming changes and features in the DeFi space to keep your platform competitive.

Ethereum

Binance Smart Chain (BSC)

Polygon

Node.js

TypeScript

Web3.js

Ethers.js

React.js

Next.js

Redux

MongoDB

PostgreSQL

OpenZeppelin

Slither

The Nexcenz team has experience building efficient DeFi solutions in a wide range of industries; customization of our solutions to your particular business needs is the primary goal. User-friendliness remains important, helping traders utilize the platform.

Customer feedback and reviews are our major concerns! Here we have shared a Ratings of our reputed clients

You let us know what you need, Technical experts will call to review your needs in detail.We promise to keep all information private.